Prime Day is the most important event in the Amazon marketplace. They have significant impact on both the seller performance and consumer behavior. With DataHawk’s powerful marketplace analytics capabilities, we dug deep into the performance of Prime Day 2024 (July 16–17) and the extended four-day event in 2025 (July 8–11). Here are some of the key takeaways we found:

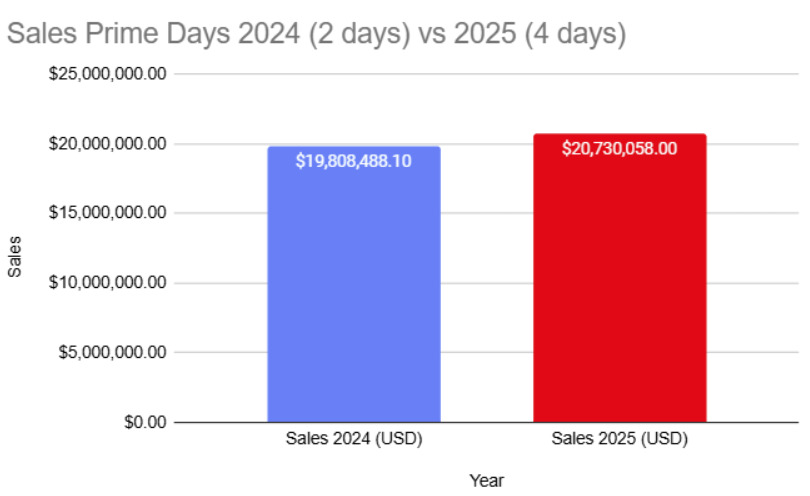

Overview of Sales Growth

Overall, Prime Day 2025 saw a modest sales increase of 4.65% when we compared it to 2024 data. The event expanded from two to four days, generating a total sales of $20.7 million compared to $19.8 million in the previous year.

Even though Prime Days 2025 doubled the duration from two to four days, the total sales increase suggests the additional event days yielded diminishing incremental sales returns.

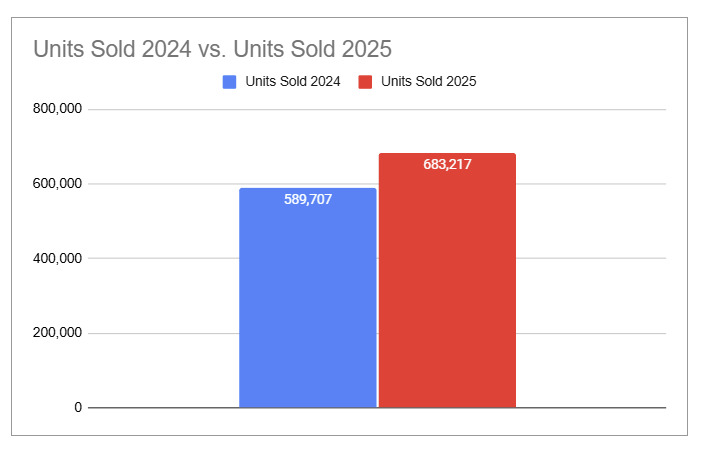

Units Sold Surge

The number of units sold increased significantly by 15.86%, with a jump from 589,707 units in 2024 to 683,217 units in 2025. DataHawk’s advanced tracking enabled organizations to monitor units sold, helping them optimize inventory and pricing strategies effectively.

The significantly higher percentage increase in units sold (15.86%) compared to total sales (4.65%) indicates a lower average selling price per unit during Prime Days 2025.

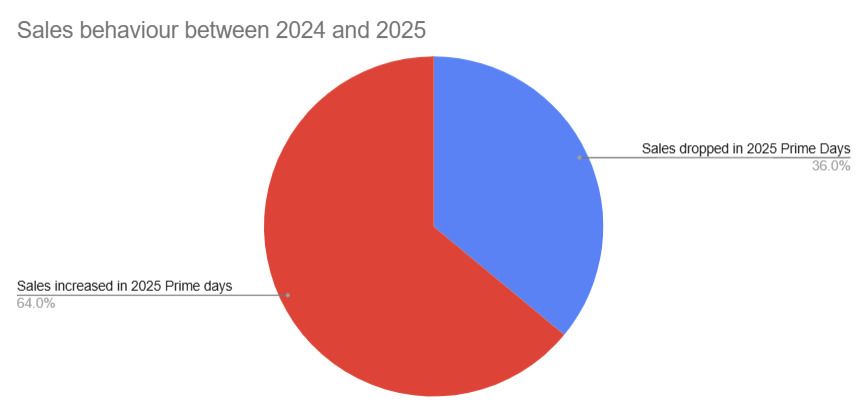

Sales Performance Across Client Accounts

Despite overall growth, 36% of client accounts experienced sales drops during Prime Days 2025 when compared to the previous year. DataHawk’s segmentation and automated alerts for critical product changes helped organizations quickly identify declines, diagnose issues, and adjust strategies during the event.

Despite overall sales growth, the substantial proportion (36%) of accounts experiencing a drop indicates varying seller effectiveness during Prime Days, highlighting opportunities for strategic improvement at the account level.

Market Segment Performance Analysis

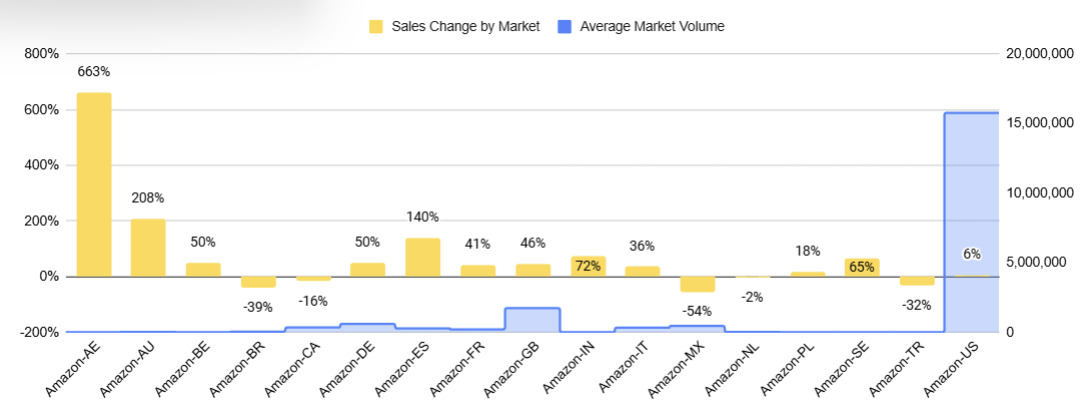

Using DataHawk’s robust market analytics, we were able to pinpoint significant marketplace fluctuations and identify the winners and losers. See below for what we found:

- Amazon Mexico (MX) and Brazil (BR) faced notable declines, their sales dropped 54% and 39%, respectively.

- Amazon Spain (ES) saw a remarkable growth of 140%. Highlighting this as an emerging marketplace opportunity for sellers to tap into.

- Amazon UAE (AE) and Australia (AU) experienced significant growth (663% and 208%.) This can be largely be disregarded due to low baseline sales volumes.

The notable growth in Amazon ES (140%), GB (72%), and SE (65%) highlights that these markets as strong opportunities to increase investment. However, the significant declines in Amazon MX (-54%) and BR (-39%) suggest these markets faced greater challenges and sellers should be diligent.

How DataHawk Powered These Insights

DataHawk’s analytics platform was instrumental in uncovering these detailed insights through:

- D-1 Sales Tracking: Which allows sellers and organizations to quickly respond to changes in sales dynamics.

- Account Performance Dashboards: Clearly indicated winners and losers across markets and accounts, prompting timely strategic adjustments.

- Market Segmentation Reports: Identified specific market behaviors, allowing precise, localized marketing and inventory strategies.

- Automated Alerts: Provided immediate notifications on unusual sales fluctuations, enabling proactive interventions.

Final Thoughts on Prime Day

The extended four-day format in 2025 provided mixed outcomes. Amazon saw overall sales and units sold increased, but account-level performance varied significantly. The sellers, agencies, and business leaders using DataHawk were able to quickly identify both opportunities and threats to maximize performance this year.

Ready to see how DataHawk can help you succeed on the Amazon marketplace? Book a demo today!