TL;DR

- Share of Voice (SOV) tells you how much visibility your brand wins in search results and ad placements compared to your competitors. Treat it as a leading indicator for sales momentum, not the finish line.

- You can calculate SOV with a simple count, but tracking weights by position and by “on‑page real estate” (what appears above the fold matters more).

- Track SOV at the keyword, cluster, category, and placement levels. Build consistent time‑series, then read SOV alongside conversion, price, reviews, and Buy Box to explain movement.

- DataHawk computes Share of Voice from keyword ranking data on Amazon and Walmart, supports sponsored rank coverage (via Premium Keywords), and ships Share of Voice metrics into your BI tools like Power BI.

What Share of Voice (SOV) actually means

Share of voice measures the visibility your brand captures in search vs everyone else. On Amazon, that usually means how often your products or ads appear in the results for a given keyword, cluster, or category. It’s the visibility side of the equation, market share is the revenue side and you need both.

Two views that matter:

- Organic SOV = your presence in organic results.

- Sponsored SOV = your presence in paid placements (Sponsored Products, Sponsored Brands, video, etc.).

Most teams track each separately, then report a blended view when leadership wants one KPI.

Quick contrast

- SOV = visibility in search and ad placements.

- Share of Shelf = on‑page real estate on PDPs and carousels.

- Market share = sales.

They’re all related but not interchangeable.

Why smart brands run on SOV

Search is the entry point to demand. If you don’t show up where shoppers are searching, you won’t be considered during the evaluation process. That’s why SOV works as a compass, not a vanity metric.

- Early signal. SOV often moves before revenue when you turn on campaigns, lose rankings, or a competitor increases their budget.

- Budget clarity. It shows where to defend branded queries, where to target, and where you’re already dominant and can shift spend.

- Category context. SOV shows you who’s actually winning the top positions for the keywords that matter most in your niche. You can make decisions based on real data, not just the stories your ad platforms try to sell you.

There isn’t a universal “good” SOV. A general rule of thumb is to aim for around 20–30% share as a starting point in important general categories. If the numbers make sense, push for 40–50% to really lead the pack. These are just suggestions for a starting point, not strict rules you have to follow.

How to calculate Amazon Share of Voice

Let’s walk through it, starting easy and getting more detailed, using just one search term as an example.

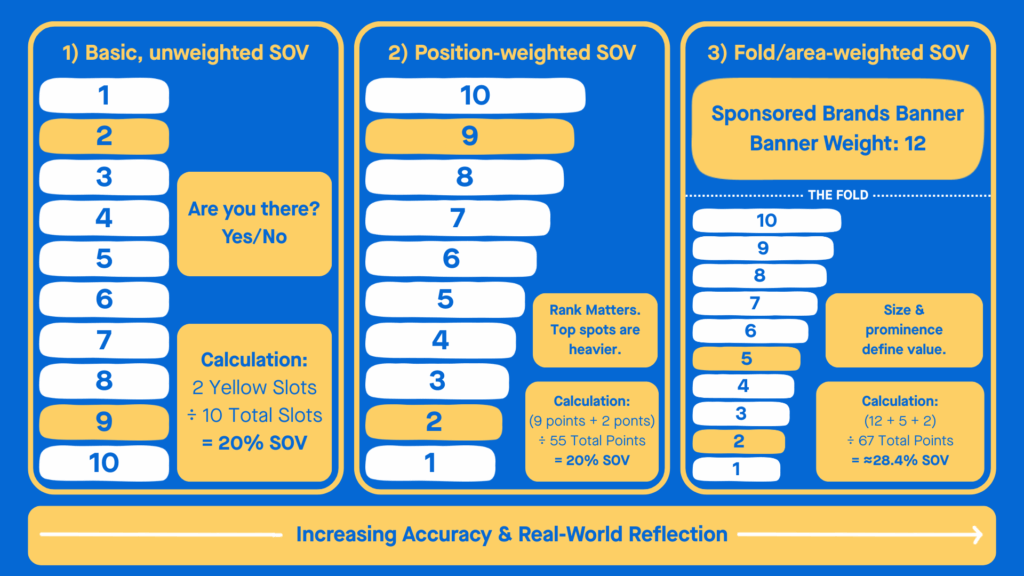

1) Basic, unweighted SOV

Formula:

SOV (%) = your brand’s appearances ÷ total appearances × 100

Example: Say you have 2 products in the top 10 results, that’s a 20% SOV. That number is quick to grab, but it misses a key point: the #1 spot gets significantly more visibility than the #9 position.

2) Position‑weighted SOV

Assign more weight to higher ranks. One practical scheme for the top 10:

- Weights 10..1 for positions 1..10

- Total page weight = 10 + 9 + … + 1 = 55

- If you hold positions 2 and 9: points = 9 + 2 = 11

- Weighted SOV = 11 / 55 = 20%

Same numeric result here, but position‑weighting scales better across complex mixes and reflects shopper behavior.

3) Fold/area‑weighted SOV

Add weight for above‑the‑fold modules that occupy more real estate, such as the Sponsored Brands banner. Example scheme:

- Sponsored Brands banner = 12 points

- Positions 1..10 = 10..1 points

- Total page points = 12 + 55 = 67

- If you own the banner and rank #6 and #9: points = 12 + 5 + 2 = 19

- Weighted SOV = 19 / 67 ≈ 28.4%

This better captures the visibility your brand truly owns on the page. (Weighted methods like position and fold weighting are widely referenced in leading SOV guides.)

Bottom line: pick a model, write it down, and use it consistently so trends mean something.

What to measure SOV on

To make SOV actionable, slice it the way you plan budgets.

- By intent: branded, competitor, and generic non‑branded terms.

- By unit: single keyword, keyword cluster, or category/browse node.

- By placement: Sponsored Products, Sponsored Brands, Sponsored Display (and video where relevant).

- By device/fold: top‑of‑search vs rest‑of‑search, above‑the‑fold vs below.

Walmart note: The concept is the same on Walmart. You’ll look at Sponsored Search placements, specifically Sponsored Products and Sponsored Brands (formerly Search Brand Amplifier) with similar weighting by rank and above‑the‑fold real estate.

Where the data comes from

You can spot‑check a page and count logos, but results continue to change and manual tracking won’t be able to keep up as you scale. Decision makers rely on:

- Keyword rank tracking: daily organic (and, when needed, sponsored) ranks across your keyword set for you and competitors. This is the backbone for organic SOV and position/fold weighting.

- Amazon data sources: Brand Analytics for search term and click‑share context, plus Ads data for impressions and placements when you’re studying sponsored SOV.

- A platform to unify it: to automate collection, apply the same weighting rules every day, compare brands, and trend it over time.

DataHawk centralizes marketplace data and supports both Amazon (Amazon Ads Verified Partner) and Walmart tracking so you can avoid screenshots and spreadsheets.

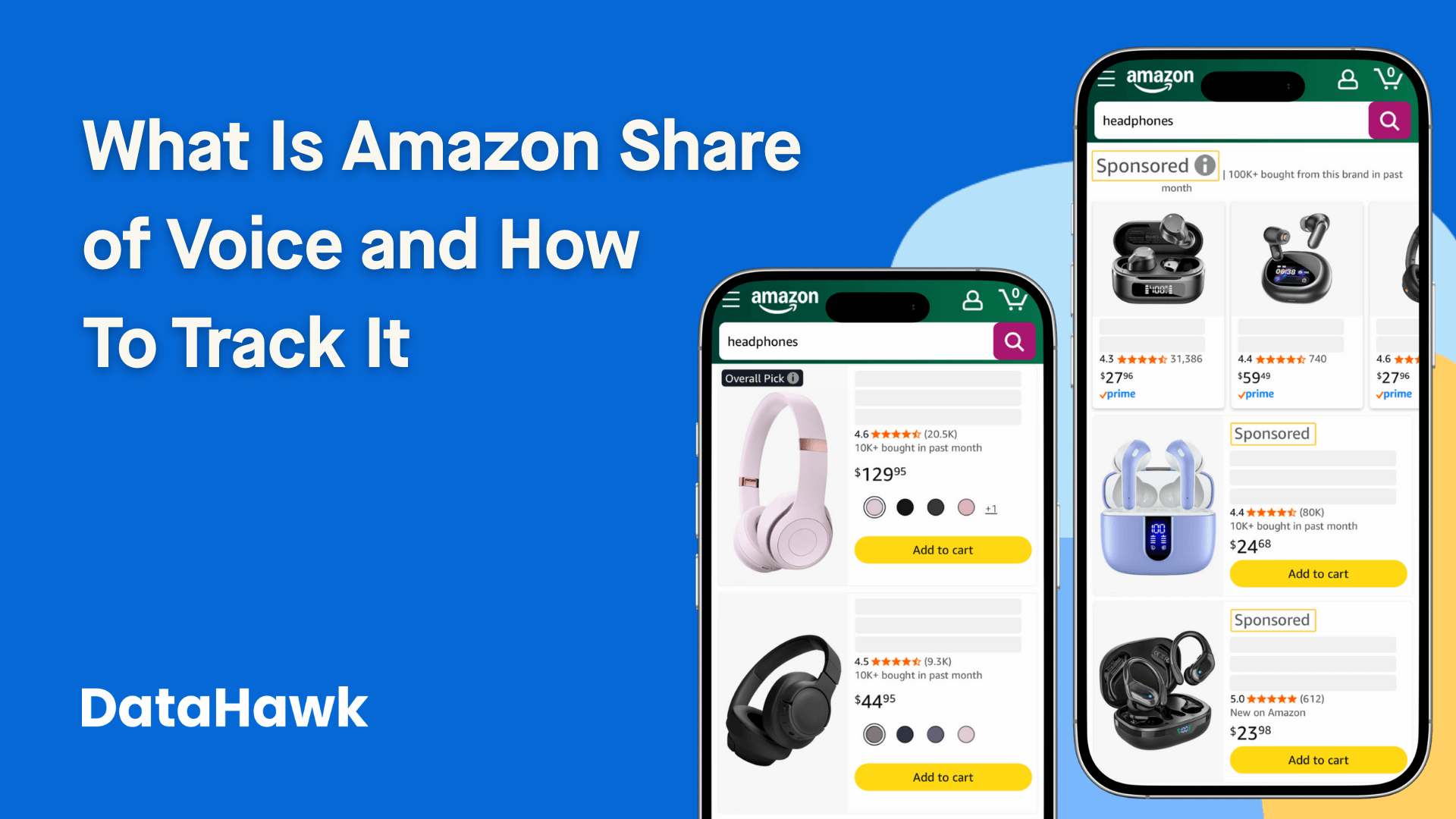

How to Track Share of Voice with DataHawk

The goal is clear visibility you can trust over time without having to hand build reports.

1) Connect and scope

Connect your Amazon and Walmart marketplace data. Define the product lines, categories, and the keyword clusters you actually plan to defend or grow (branded, competitor, and generic).

2) Build or import your keyword set

Start with your seed list and expand with reverse‑ASIN for you and your top competitors. Group terms into clusters that mirror how you allocate budget.

3) Compute SOV from rank tracking

DataHawk’s Keyword Rank Tracker monitors daily ranks on Amazon and Walmart and can calculate Share of Voice across your tracked terms. You can monitor organic ranks for everyone on the page. If you need full paid coverage just enable Premium Keywords to capture sponsored ranks with higher fidelity.

4) Layer in sponsored context

When you’re analyzing ad impact or competitor aggression, read sponsored coverage side‑by‑side with organic coverage. On Walmart, that includes Sponsored Products and Sponsored Brands. On Amazon, include Sponsored Products, Sponsored Brands, and video where relevant.

5) Trend, alert, and explain

Track SOV weekly at the cluster level. Set alerts for drops in branded SOV or unusual competitor surges. Compare those moves against conversion rate, price, reviews, and Buy Box so your updates highlight why SOV moved, not just that it moved.

6) Push to BI

If your execs live in BI, send SOV time‑series (and roll‑ups by cluster, brand, and retailer) straight into Power BI or Looker Studio. DataHawk publishes ready‑to‑use Power BI templates that include Search and Share of Voice pages, so you can stand up a baseline view quickly and customize from there as needed.

What is a good SOV target?

Margins, competition, brand strength, and supply chain are all important metrics. Here’s a practical way to set targets:

- Branded terms: aim for near‑ownership. If you’re below 70–80% on your own brand, fix that first.

- Priority generics: 20–30% is a foothold that typically drives meaningful traffic.

- Core generics leadership: 40–50% often looks like leadership. Make sure the unit economics still work at that level.

A quick health check: if your SOV > market share, you’re set up for growth. If SOV < market share, you could be over‑earning on brand strength or distribution and need to invest in visibility.

How to grow share of voice (SOV)

Before you pay to show up more, make sure you deserve the click.

1) Fix conversion levers

- Content: clean titles, clear bullets, strong image stack, and A+.

- Social proof: review count, rating distribution, and recency.

- Price and promos: sustainable price architecture; don’t whiplash.

- Buy Box: if you don’t own it, paid SOV results in wasted spend.

2) Run ads with intent

- Sponsored Products for bottom‑funnel defense and surgical conquesting on competitor and generic terms.

- Sponsored Brands to expand your above‑the‑fold footprint and tell the brand story.

- Retargeting and video where it fits your category.

On Walmart, plan budgets around Sponsored Search (Sponsored Products + Sponsored Brands). On Amazon, include Sponsored Products, Sponsored Brands, and video placements. Weight the impact by placement and fold in your SOV model.

3) Measure incrementality, not just ROAS

Track how SOV, rank, and sales move together. When Sponsored SOV increases but sales don’t, you’ve got an issue with conversion or availability. When organic SOV rises after a paid push, that’s the halo effect you want, note it down and scale.

FAQs

Is SOV just a paid metric?

No. Many retail‑media conversations define SOV in paid terms, but for marketplace operators, you should track both organic and sponsored visibility to get the full picture.

What’s the easiest way to start tracking SOV?

Pick 20–30 priority keywords per product line, set a simple position‑weighted model, and trend SOV weekly. Expand to clusters and sponsored coverage once your workflow is stable.

How often should we measure SOV?

Weekly is enough to catch meaningful trends. During peak events or tests, you should watch daily.

Do I need perfect denominators for totals?

No. Be consistent: same keyword set, weighting, time window, and competitor list. Direction and deltas beat one‑off precision.

Does this Share of Voice (SOV) approach apply to Walmart?

Yes. The approach is the same. Your placements are Sponsored Products and Sponsored Brands within Sponsored Search, and you’ll still weigh position and fold.

How DataHawk helps teams operationalize SOV

- Unified marketplaces. Track and report Amazon and Walmart in one place. DataHawk is an Amazon Ads Verified Partner and a Walmart solution provider, so you can connect data reliably and get the executive‑ready views your organization needs.

- Rank‑based SOV with sponsored options. Compute SOV from consistent rank data, and enable Premium Keywords when you need fully supported sponsored rank coverage.

- BI‑ready. Push clean SOV datasets into Power BI and Looker Studio. Start with a Search Power BI template that includes Share of Voice, then tailor it to your model and clusters.

Book a free demo today so one of our experts can walk you through how DataHawk’s marketplace insights can help you get the share of voice insights you need to succeed.